Setting up Overtime Rates

Set a multiplier value for your overtime to have them reflected in timesheet export calculations.

Employees covered under the Fair Labor Standards Act (FLSA) act are required to have a “time-and-a-half” (1.5X) overtime pay for hours worked exceeding 40 in a workweek.

Similarly, other countries require different multiplier values/scale factor added to their overtime hours to comply with concerned labor law for fair overtime pay.

In Jibble’s time tracking software, this would mean adding a customizable overtime multiplier rate to facilitate the calculation of overtime pay.

This guide will cover:

Setting up Overtime Rate

-

Before setting up your overtime rate, ensure that you have set a billable rate for your team members by updating their profile details.

-

Once billable rate is set up, go to Work Schedule Settings.

-

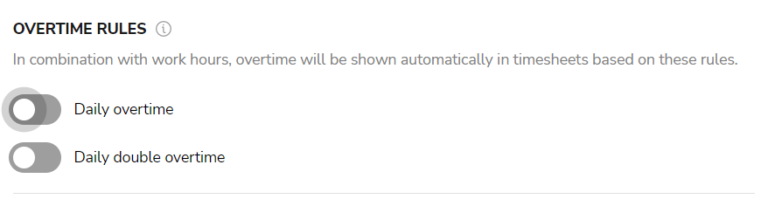

Set up and manage work schedule preferences then scroll down to the “Overtime Rules” section.

-

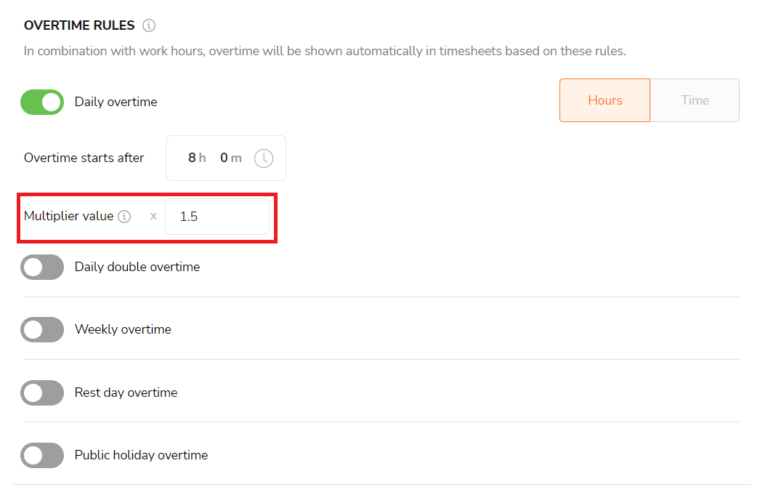

Enable your preferred overtime rule by enabling it’s toggle. Choose whether overtime starts after X time or after X hours (i.e.. Overtime occurs after 8 hours or after 5.00pm).

-

Set your multiplier value. Value entered will be applied to overtime hours beyond prescribed threshold (as selected in Step 4).

-

Hit the “Save” button.

Note: Weekly overtime rate will be viewable in timesheet exports in a near release (Coming soon!).

Viewing Overtime Pay in exports

Overtime Rates will contribute to the overall Billable Amount in timesheet exports.

Note: Overtime rate calculations will only apply to raw timesheet exports. We’re adding it to timesheet summary and all timesheet related exports in a near release.

To view Billable Amount with Overtime pay:

-

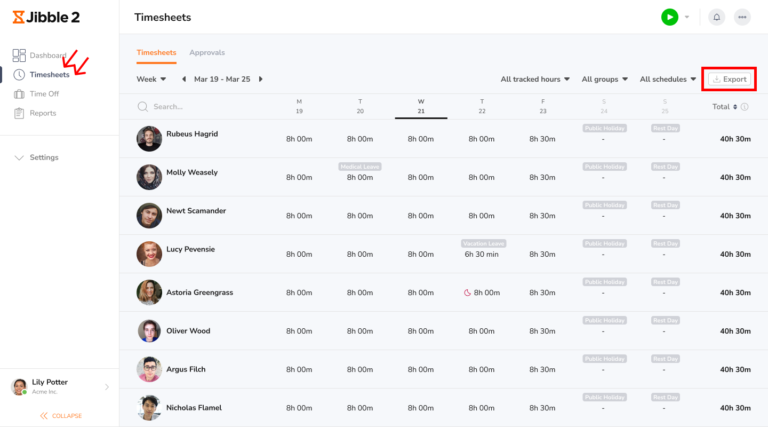

Go to Timesheets and click on the Export button.

-

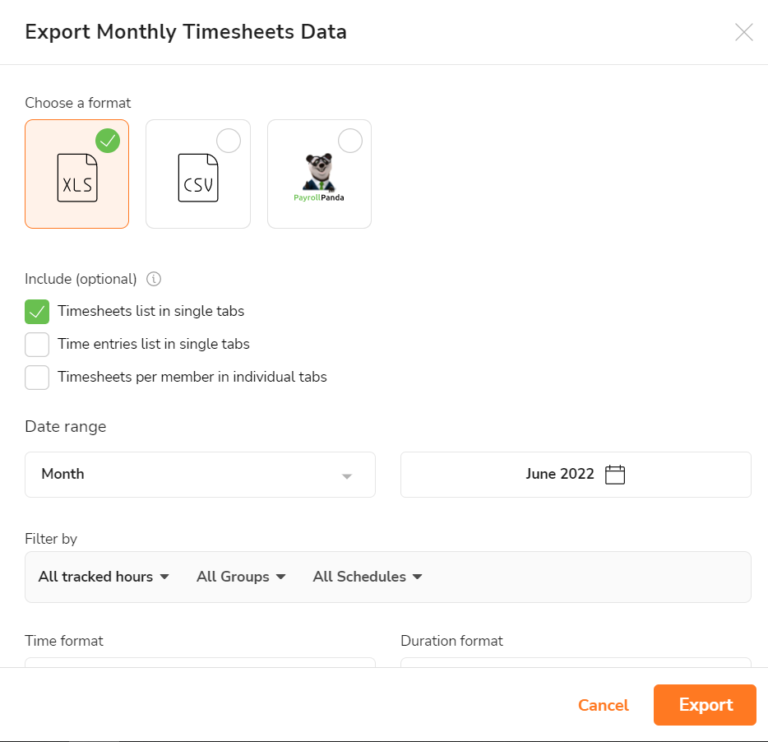

Select “Timesheets list in single tabs” to export your raw timesheets.

-

Select your preferred date range, filters, time and duration format for your export.

-

Hit the Export button.

-

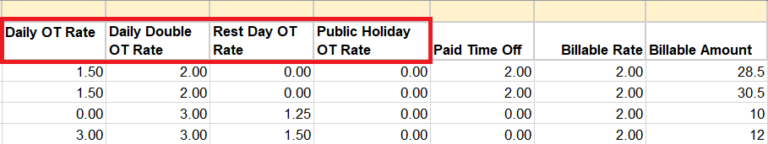

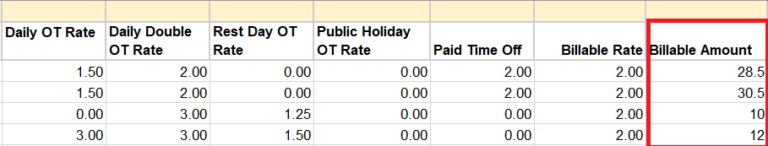

In your export file, you can view your set overtime rates under the R to U columns.

-

Your Overtime Pay will be reflected under Billable Amount column.

Billable amount & Overtime rate Calculations

Formulas used for Overtime Pay:

|

|

Formula |

|

Overtime rate |

Multiplier Value*Billable Rate |

|

Billable amount |

(Billable Rate)*(Regular Hours) + (Paid Time Off)+(DailyOTRate*DailyOT)+(DailyDoubleOTRate*DailyDoubleOT)+ (PublicHolidayOTRate*PublicHolidayOT)+(RestDayOTRate*RestDayOT) |

*The same formula is used for billable amount in raw timesheet exports regardless if it’s a public holiday, rest day, or working day.

Example 1

Francis is working on Monday, which is a working day, he has:

-

8 hours of working time (regular hours).

-

2 hours of Daily Overtime.

-

2 hours of Daily Double Overtime.

-

No hours recorded for Public Holiday OT or Rest Day OT.

-

2$/hour for Billable rate.

-

Multiplier value of x1.5 for Daily Overtime and x1.5 for Daily Double Overtime.

Overtime Rate Calculations

Formula for Overtime Rate : (Multiplier Value*Billable Rate)

-

DailyOT Rate : (1.5*2) = 3

-

DailyDoubleOT Rate : (1.5*2) = 3

Billable Amount

Formula for Billable amount = (Billable Rate)(Regular Hours + Paid Time Off)+(DailyOT Rate)(DailyOT)+(DailyDoubleOT Rate)(DailyDouble OT)+ (PublicHolidayOT Rate)(PublicHolidayOT)+(RestDayOT Rate)(RestDay OT).

-

2*(8+0)+(3)(2)+(3)(2)+(0)(0)+(0)(0) = 16+6+6 = 28.

-

Billable amount = 28$

Example 2

Francis worked for 8 hours on a public holiday. He is working on a Sunday, which is also considered as Rest day, he has:

-

0 Regular hours, since any time worked on a public holiday is considered as public holiday overtime (Francis has public holiday overtime enabled*).

-

8 hours of Public Holiday OT.

-

0 hours of Rest Day OT (when rest day and public holiday falls on the same date, Public Holiday OT takes precedence.

-

2$/hour for Billable rate

-

Multiplier value of x1.5 for Public Holiday OT, and x2 for Rest Day OT.

-

0 paid time off for this date.

Overtime Rate

Formula for Overtime Rate : (Multiplier Value*Billable Rate)

-

PublicHolidayOT Rate: 1.5*2= 3

-

RestDayOT Rate: 0*2=0

Billable Amount

Formula for Billable amount = (Billable Rate)(Regular Hours + Paid Time Off)+(DailyOT Rate)(DailyOT)+(DailyDoubleOT Rate)(DailyDoubleOT)+ (PublicHolidayOT Rate)(PublicHolidayOT)+(RestDayOT Rate)(RestDay OT).

-

2*(0+0)+(0)(0)+(0)(0)+(3)(8)+(0)(0)= 24

-

Billable amount is 24$ for those 8 hours.