As a CEO of a time tracking software company I need to know what my competitors are up to. That means I’m often researching about and/or playing around with their products, you know, it’s part of the job. Here, I share my findings of that research, giving credit to those competitors where credit is due and being honest about which products I believe you really need to avoid. And so, there you have it, this review, and in it, I try to be honest, fair, and insightful…

This review covers:

- Overview

- What Users Like

- What Users Don’t Like

- Pricing Plans

- Standout Features

- Positive User Highlights

- Negative User Highlights

- Ratings from Other Reviews

Overview

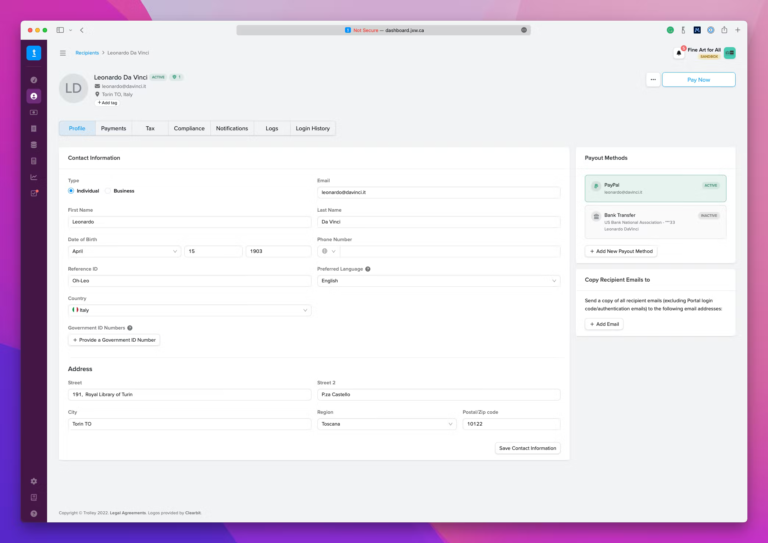

Trolley, formerly called Payment Rails, is a platform for businesses to send payments and process payroll globally. The software offers payroll features such as onboarding, compliance, and year-end tax reporting.

Trolley enables businesses to automate payment approval flows, manage returned payments effortlessly, and monitor live payments in real-time with accurate foreign exchange rates. Along with fraud detection, Trolley also offers recipient and vendor management, approval process control, and cash management. I like how the software has a customizable recipient widget that can be integrated into users’ websites or mobile apps and includes bank validation rules for multiple countries. Its most impressive standout feature according to me is the geolocation support through a built-in time clock – amazing. Further, Trolley offers expanded earning types and robust employee records.

However, I do have some concerns about the software. While Trolley offers a variety of global payroll features, it has some drawbacks such as a steep learning curve that leads to a difficult onboarding process. Additionally, users cannot save their passwords when logging in, and it remains unclear what the payment status of employees is once payments have been sent out.

What Users Like

- User-friendly interface

- Built-in time clock supports geolocation

- Expanded earning types

- Employee records and employee portals

- Year-end tax reporting

What Users Don’t Like

- Difficult onboarding process

- Password cannot be saved when logging in

- Unclear payment status

Pricing Plans

Trolley offers three pricing plans for its e-commerce platform: Grow Plan, Platform Plan, and Enterprise.

Grow Plan: At a base fee of US$49/month, the Grow plan includes features like unlimited products, orders, and file storage. It also includes website customization options, SEO tools, unlimited users, recipients, and payments, along with phone, email, and live chat support. This plan offers a recipient portal and widget, CSV file uploads, notifications, reporting, bank account validation, and more.

Platform Plan: At a base fee of $199/month, the Platform plan includes all of the Grow plan’s features plus additional benefits like PayPal Payouts, low FX rates to 135+ currencies, white-label email notifications, invoices with line-item-level payment details/tax categorization, multiple currency balances, and more.

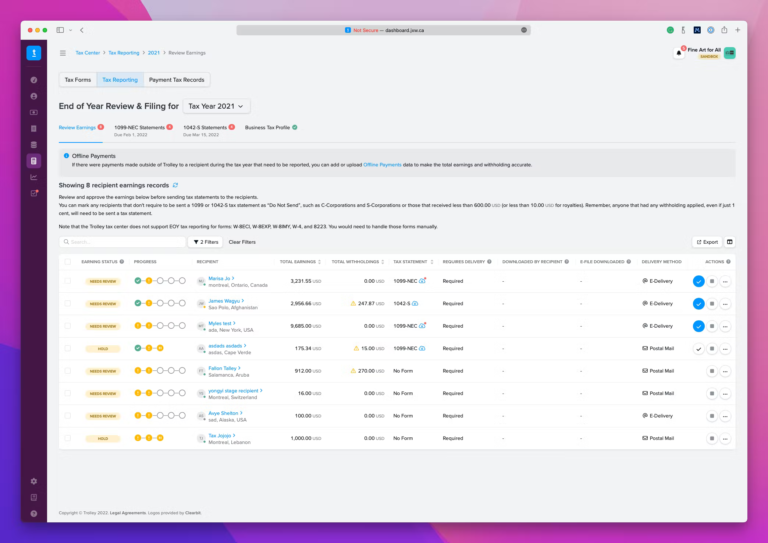

Enterprise Plan: This plan offers customized pricing and includes all of the features from the Platform plan, along with advanced options like AML and compliance watchlist screening, W9/W8 tax form collection, 1099 and 1042-S end-of-year tax statements and e-file generation, REST API access, and Zapier integrations.

Standout Features of Trolley

1. Compliance tools

Trolley offers compliance tools and services for businesses to meet regulatory requirements and comply with global payment regulations. These include automated KYC verification and AML screening tools to mitigate fraud and money laundering risks. Compliance reporting tools generate reports for regulatory authorities, and data protection measures make sure businesses comply with global regulations like GDPR and CCPA.

2. Automated payment processing

Trolley offers automated payment processing features that include bulk payments, scheduled payments, and customizable payment rules for payment routing and processing. It also provides real-time payment tracking and automated payment reconciliation tools that match payments to invoices and track payment activity.

3. Real-time payment tracking

Trolley’s real-time payment tracking feature provides businesses with payment status updates, notifications, and history. This feature offers transparency, visibility, and control over payment operations. It also provides analytics tools enabling businesses to track payment trends, monitor payment volumes, and optimize payment processing.

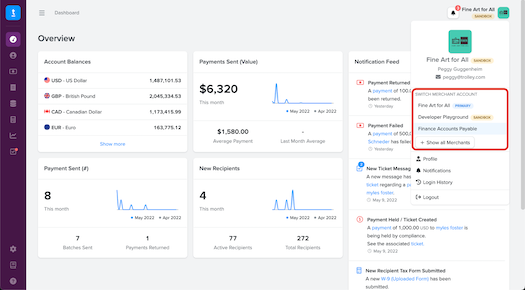

![]()

4. Reporting

Trolley’s reporting allows businesses to track financial performance and monitor transactions. Features include transaction history, payment analytics, financial reporting, compliance reporting, and custom reporting. These features provide valuable insights into payment trends, financial performance, and regulatory compliance.

Selected Positive User Feedback:

- “Ease of use for our customers to log their direct deposit information through the PR plugin, CSV upload for payout to customers (no more manual logging of individual’s payout), and (now most recently) customer access to view payment history.” – Jordan S. (Source Capterra)

- “Payment rails makes payments easy with a robust API that works across borders. They also handle tax compliance and have a knowledgable team that’s always ready to help.” – Verified Reviewer (Source Capterra)

- “Once set up, it was easy to use. Dashboard/interface is great and user friendly.” – Jonah C. (Source Capterra)

- “User-friendly, very easy to learn and use.” – Tony T. (Source Capterra)

- “What we liked the most is the ease of use of their APIs and especially their widgets which are super easy to integrate with and set up.” – Luis S. (Source Capterra)

- “Ease to enter information for a payee, easy to track all your payments, export functions, allowing multiple users (auditor, collaborators), the two-person process for payouts, easy process to pull money into the platform.” – Verified Reviewer (Source Capterra)

- “Payment Rails has a UI which is very easy to use if you are doing manual payments within the Payment Rails platform, but they also have a fantastic API which we were able to integrate into our proprietary platform so we can make payments without our existing workflow.” – Jeremy C. (Source Capterra)

- “Super easy to use and the interface is very customer friendly. The customer support team is very friendly and helpful.” – Verified Reviewer (Source Capterra)

- “The Payment Rails dashboard is best-in-class. We’ve used a number of third-party payments platforms and as something we spend a lot of time using it’s important for it to be modern, usable, and fast.” – Locke B. (Source Capterra)

- “Payment Rails enables our two-sided marketplace to pay freelancers in nearly every country in the world in just a few days with their local currency. It handles FX and all the headaches involved with taxes.” – Sam W. (Source G2)

- “The convenience of paying out users on a daily to weekly basis, generating of US Tax forms for independent contractors.” – Jordan S. (Source G2)

- “Payment Rails has streamlined our process with easy importing and exporting of payable amounts and one-click payments. The email templates are attractive and professional-looking. The dashboard gives us transparency and all the details readily available through an easy interface.” – Valeria S. (Source G2)

- “My artists can receive their tax forms thru their account, and receive payment by bank transfer and paypal.” – Tanvi P. (Source G2

- “Easy pay, transaction report, balance report showing the change in balance.” – Iva F. (Source G2)

- “Centralized platform, full visibility on all that is happening, intuitive, different balances.” – Alexandra S. (Source G2)

Selected Negative User Feedback:

- “The only one worth calling out is the onboarding process takes more time than expected.” – Sam W. (Source G2)

- “The code for login into the portal sometimes never arrives. It often happens with certain recipients that can’t log in or say the code takes ages to arrive. It doesn’t allow to save passwords as well.” – Alexandra S. (Source G2)

- “Does not allow payments to be sent internationally in USD.” – Byran H. (Source G2)

- “Unable to batch non-USD payments with USD payments – would make it easier to send one whole batch.” – Verified User (Source G2)

- “The set-up process for bank transfers was a little more difficult than desired but this is due to legal regulations and requirements.” – Spencer M. (Source G2)

- “Bulk importing of tens of thousands of recipients was slightly tedious. We had to break our list up into groups of around 1000 recipients each to avoid issues.” – Locke B. (Source Capterra)

- “The backend interface could use some improvements; it can sometimes be difficult to find the information you look for.” – Verified User (Source Capterra)

- “I wish onboarding would be less time-consuming.” – Oleg P. (Source Capterra)

- “It’s hard to learn how to use. If you did not have someone teaching you how to use it, it would be incredibly difficult to figure out.” – Jennifer H. (Source Capterra)

- “Trying to track down a payment that went to a closed bank account for a client. Took a couple of weeks to resolve.” – Beth W. (Source Capterra)

- “Some sections have some small bugs but these are fixed within 24-48 hours of reporting them to the PR team.” – Nathan S. (Source Capterra)

- “Unsure about payment status beyond sending it out. Too many angry workers not sure where their money is and not being able to know why it isn’t in their account if there was an issue.” – Sebastian J. (Source G2)

- “There is not currently a way to download a monthly statement. I have to go to 3 or 4 different screens to view all of our transactions.” – Ryan W. (Source Capterra)

- “It does take a little bit to get set up and approved for bank transfer payouts but they’ve really tried to simplify the process as much as possible and are lightyears ahead of anyone else.” – Spencer M. (Source Capterra)

- “It does not have the option to save my password when I log in.” – Heather H. (Source Capterra)

Ratings from Other Reviews

(As of 04/20/2023)

- Capterra: 4.7/5

- G2: 4.9/5

- Software Advice: 4.67/5

- TrustRadius: 3.7/5

Final Thoughts

Trolley, formerly called Payment Rails, streamlines payroll operations and provides transparency with features like fraud detection, cash management, live payment tracking, and real-time foreign exchange rates. Moreover, the software also offer other features such as automated payment flows, year-end tax reporting, and onboarding of new employees.

One of the things I appreciate most about Trolley is its ability to seamlessly handle returned payments. The software’s financial reporting features are also extremely useful in ensuring compliance with global payment regulations. Along with a customizable receipt widget and a user-friendly interface, Trolley also offers an in-built time clock with geolocation functionality.

Given its variety of features, I think Trolley is a competent payroll software but has some drawbacks. A concern I have is that the software has no clear way to track payments once they are sent out to employees, which leads to confusion and frustration during the payroll process. Disappointingly, users are unable to save their passwords while logging in, and the platform has a difficult onboarding process with a steep learning curve.

To conclude, Trolley caters well to large businesses worldwide through its real-time foreign exchange rates and filing of year-end taxes, but I believe the ability to track payments after they have been sent out would make the software shine even more.